Opportunities for Renewable Energy in Ethiopia and Tanzania

Energy is the foundation necessary for a country to build its economy and lifts its people out of poverty and yet its production can have detrimental effects on a country's environment. Driving private capital investment in renewable energy in Ethiopia and Tanzania balances both requirements and has the opportunity to create significant impact.

1) Recommendations for Addis Ababa and Ethiopia: How to create additional value in the Industrial Parks strategy?

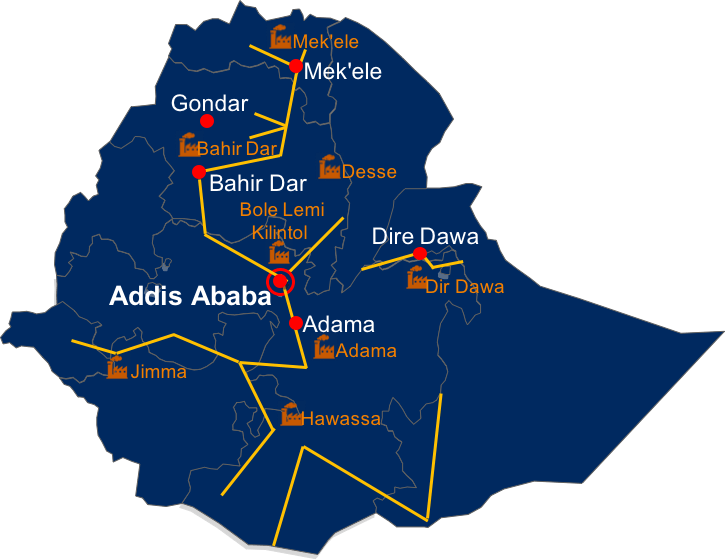

Ethiopia has experienced remarkable growth over the past decade and is a country ripe with opportunity. With aspirations to reach lower-middle-income status by 2025, Ethiopia experienced average GDP growth of 10.5% a year from 2005/06 to 2015/16, compared to a regional average of 5.4%.1 Much of the country’s advancement was fueled by expansion of services and agriculture and as the country looks to its future, industrialization and growth of manufacturing is key to its strategy. Dr. Arkebe Ogubay, Minister and Special Advisor to the Prime Minister of Ethiopia, describes manufacturing as “an engine of growth, because it is positively causally related to the growth of GDP and rises in productivity in the whole economy.”2 The country’s Second Growth and Transformation Plan (GTP II), which incorporates learnings from the rise of the East Asian Tigers in the 1970s-1980s, aims to build infrastructure and develop 15 industrial parks by 2020 as indicated on figure 1.3

Figure 1: Illustrative Map of Ethiopia showing Industrial Parks and Grid

The country estimates that by 2025 its capacity requirements for reliable energy will rise from 4GW to 25GW (an over six-fold increase) driven by economic growth and increasing electrification coverage from 23% to 90+%. In addition to increasing its power generation and reducing its aggregate losses from 20% to 11%, Ethiopia must also maintain its attractive electricity tariff rate to attract foreign investment to its industrial parks. For one, the tariff rate of 3 cents USD per kilowatt hour is among the cheapest in the region and a selling feature for investors. Given this limitation in increasing the tariff rate, Ethiopia’s public sector must find other sources to improve the bankability of its energy projects.

Moreover, although the country already receives much of its energy from renewable sources (86% hydroelectric, 8% other renewable sources, and 6% thermal4), there is an opportunity to diversify its energy mix. Diversification will reduce its exposure to geopolitical and climate change risks created by its overdependence on hydroelectric. For example, regarding geopolitical risks, the Grand Ethiopian Renaissance Dam (GERD), which is expected to deliver 6,000MW of electricity to the country, will also disrupt the flow of the Nile to Egypt’s 100M people.5 Thus, Ethiopia should be concerned about mitigating the potential effect on both Egypt’s agricultural and industrial sectors.

Geothermal for Industrial Parks

Due to its proximity to the East African rift, Ethiopia is rich with geothermal resources. In fact, in December 2017, the country signed agreements for two 500MW geothermal pilots, Corbetti and Tulu Moye, with much international support. The Corbetti pilot signed with Icelandic developer Reykjavik Geothermal (RG) is Ethiopia’s first independent power project and can serve as a launching ground for much needed future projects. There are several levers the private sector and public sector should pull to increase investment in geothermal energy in the country and meet its baseload requirements.

Firstly, the private sector should require feed-in tariffs for geothermal energy projects. The need for feed-in tariffs results from the fact that at the current rate of 3 cents USD per kilowatt, private investors will never be able to recover their costs. Additionally, to mitigate the counterparty risks they face working with Ethiopia’s government, the private sector should negotiate collateral / guarantees. Lastly, geothermal projects have relatively long exploration periods of up to 10 years and is best characterized as hit-or-miss. Thus, the private sector should utilize Geothermal Risk Mitigation Facility (GRMF) funding to mitigate the risks they face during early stage exploration.

Moreover, while availability of cheap, reliable energy is a critical component of the industrial park strategy, it is the first of many components of a multi-sector solution. For example, the Ethiopian government must also prioritize providing sanitary solid waste management that limits pollution to water systems, efficient inter-city transportation between parks and ports, and quality urban transportation and residential housing for workers, etc.

Off-Grid and Mini Grid Opportunities for Rural

Only 8% of Ethiopia’s rural population has access to electricity.6 Lack of electricity access limits productivity in these rural areas, exacerbates urbanization trends, and strains resiliency of cities like Addis Ababa where much of the population migrates in search of economic opportunities. To achieve its electricity coverage and connectivity access targets, the country plans to utilize 35% off-grid and 65% on-grid solutions in the next 3-5 years.7

Private sector investment to provide reliable distributive technology for rural areas (e.g., solar panel, lanterns) can be achieved through leveraging development financial institutions (DFIs) to build trust, increase project bankability, and transfer expertise.

On the other hand, mini-grids pose the greatest challenge in terms of bankability – despite substantial willingness to pay, the usage rates are too low in these rural areas to recover the high capital expenditures associated with mini-grids. However, mini-grids provide significant rewards in bringing communities together and serving as the nucleus for small-scale industrial activity. Therefore, we recommend that private investors cross-subsidize mini-grids through high-quality off-takers (e.g., mobile charging, private schools, light industry) to improve their bankability and that NGOs get involved to further the growth of this segment.

2) Recommendations for Dar es Salaam and Tanzania: How to create value by reducing sprawl and the impacts of sprawl?

Tanzania, similarly to Ethiopia, is experiencing strong GDP growth averaging 6-7% over the past decade, aiming to reach middle-income status by 2025.8 The country’s Five-Year Development Plans (FYDP) drive the growth strategy, with the second FYDP currently focused on improving agricultural productivity, enhancing the businesses environment, and managing urbanization. Some of this growth, however, is hampered by the country’s low electrification rates that are below Sub-Saharan averages. Currently, only an estimated 15.5% of the country has access to electricity, with the overall capacity required to increase nearly seven-fold to power its goals (from the current 1.4GW to the future 10GW).9 Furthermore, as figure 2 visualizes, the energy sector relies heavily on traditional energy such as natural gas and hydropower, giving opportunity to new renewable sources of energy.

Dar es Salaam also faces significant sprawl issues- within the next 30 years, the city is expected to add an additional 15M people, bringing its total population to over 20M inhabitants. Such growth threatens the resilience of the city as it will put immense pressure on all its systems and will drive a dire need for rapid infrastructure development. Addressing these issues of urban sprawl and resilience in Dar es Salaam is closely linked to economic development across the country, which in turn relies on a public infrastructure foundation that can only be funded through innovative public private partnerships. Given the importance of energy across most sectors, we see that driving renewable energy forth can have an impact in attracting private capital across many sectors, in particular supporting agriculture and industrial parks as per Tanzania’s FYDP.

Off-Grid Agricultural Opportunities for Rural

As we explored the issues, we realized that in order to reduce urban sprawl and its negative impacts, we need to strengthen rural areas economically in order to reduce urban migration, given that 70% of the population currently lives in rural areas. Thus, we tested various rural solutions as a way to reduce urban sprawl. We also quickly realized that in order to strengthen rural areas, it is crucial to approach the problem from a multi-sector perspective to truly achieve change. The primary economic driver in rural areas is agriculture, however, significant work is required to develop Tanzania from subsistence farming to larger-scale agriculture that can be an economically viable career that will lift rural Tanzanians to middle income by 2025. In particular, we identified two key challenges preventing agricultural growth: 1) farmers lacked education, skills, and export channels necessary to increase farming yields and 2) electricity was required for any larger scale operation like irrigation and agro-processing. Private capital, however, has not had successful returns tackling these rural issues separately as the returns would be minimal when only one of the two solutions was implemented independently (e.g. Electrification only did not drive higher agriculture yields without proper education OR agriculture education only would not drive higher yields without irrigation). Our multi-sector solution to attracting private capital is centered around a joint venture between an agriculture and energy company that will tackle the problems in tandem. The energy company would install solar mini-grids (<10MW) to power irrigation and agro-processing, while the agriculture company would educate farmers on agricultural practices and create a channel for export. The JV drives electricity consumption by implementing agriculture solutions and derisks capital expenditure payback by increasing export profits which the JV will share in until CapEx and interest are paid off. Thus, value-sharing in exports will cover the program costs, while the ongoing off-grid tariff will cover the operational expenditures.

Renewable Opportunities for Export Processing Zones

It is not, however, enough to just focus on rural development as migration will occur regardless. It is of utmost importance that economic development is stimulated across the country in order to increase income for urban infrastructure projects necessary to minimize impact of sprawl. As such, driving the success of the Export Processing Zones (EPZ) is crucial as a way to industrialize Tanzania and increase its revenues. We recommend private sector rooftop solar solutions financed by non-sovereign DFI loans as an effective way to provide back-up electricity to EPZ given the somewhat unreliable grid (a huge barrier for private manufacturers and thus success of EPZs). We also recommend that the public sector implement duty-free imports of solar solutions that can increase private sector attractiveness for such necessary EPZ electricity solutions.

3) Recommendations for attracting private capital to finance and deliver public infrastructure in the next decade

Both Ethiopia and Tanzania will require significant amounts of financial resources from private investors in the near future in order to achieve their electricity generation targets and guarantee resilient and reliable grid structures in urban environments as well as the industrial parks and export processing zones respectively. In order to attract private capital and create a long-term, sustainable investment environment for renewable energy sources in East Africa, we believe that it will be of utmost importance to create an investment framework which first and foremost ensures bankability of the new projects.

Bankability can be viewed within the framework of the four Cs, which we define as cash flow, collateral, credibility, and credit.10

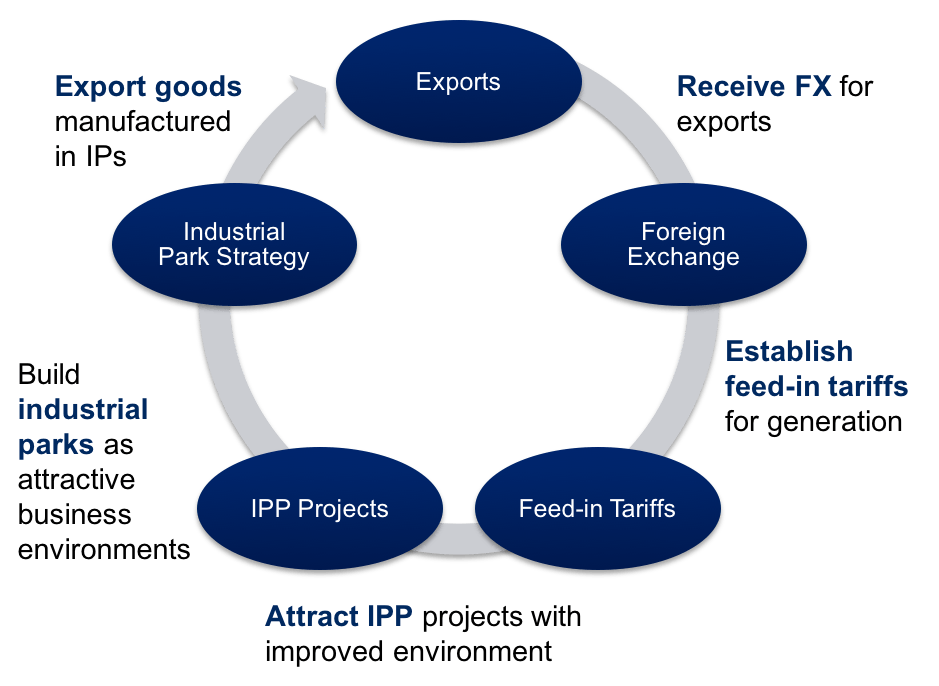

First of all, private investors will require stable, long-term revenue sources, especially when it comes to large-scale projects with significant CapEx requirements, such as geothermal projects (Corbetti’s current estimate for total CapEx requirements for the first 500MW geothermal facility in Ethiopia is $2B11 over the next ten years). We believe that competitive feed-in tariffs or similar negotiated off-take agreements in hard currencies will be required for such large scale IPPs / energy projects in order to address this concern. In both Ethiopia and Tanzania this will put significant strain on public finances, given that foreign exchange (FX) reserves are already under pressure in Ethiopia in particular.12 However, the industrial parks strategy in Ethiopia (and the EPZ strategy in Tanzania respectively) offers potential solutions to close the viability gap of this project: industrial parks will require resilient grid infrastructure as well as significant capacity increases in order to guarantee stable production conditions on the ground.13 If both energy generation and the industrial parks are developed at the same time, the resulting increases in exports will provide the FX required to ensure that feed-in tariffs can credibly be covered by the government. This crucial interplay is visualized below on figure 3.

This addresses the second C, credibility: contractual agreements in the renewable energy sector often suffer from legacy issues of past investments. Public entities need to address concerns regarding the risk of retroactive changes to off-take agreements and should budget holistically in accordance with future expected FX requirements. We believe that the macroeconomic considerations around energy exports and water resources, especially in Sudan and Egypt, might pose an additional risk in the future, which needs to be addressed in tandem with the general foreign reserves strategy. Ethiopia and Tanzania should use reference projects, such as Corbetti and Tulu Moye, in order to set standards and turn learnings from these projects (especially on the legal/regulatory side) into formal guidebooks / best practices to assist future private investors.

Finally, Ethiopia and Tanzania should enhance their credit on the global capital markets by streamlining regulatory processes for IPPs, especially the currently very cumbersome registration process for renewable energy projects. At the moment, long lead times for project approvals result in project delays and high levels of uncertainty, increasing hurdle rates for investors and hence making projects unattractive for most conventional energy investors. Especially in the <10MW space in Tanzania, a streamlined tender process would enhance bankability for private investors significantly.

References

1 “Overview of The World Bank in Ethiopia.” World Bank, www.worldbank.org/en/country/ethiopia/overview. Accessed 1/28/18.

2 Arkebe Ogubay, “Ethiopia: Lessons from an Experiment.” Industrialize Africa: Strategies, Policies, Institutions, and Financing, p. 123.

3 Ibid, p. 132.

4 “Ethiopia Power Africa Fact Sheet.” USAID, https://www.usaid.gov/powerafrica/ethiopia. Accessed 1/28/18.

5 Abdi Latif Dahir. “A major geopolitical crisis is set to erupt over who controls the world’s longest river.” https://qz.com/author/adahirqz/. Accessed 1/28/18.

6 “Ethiopia Power Africa Fact Sheet.” USAID.

7 Adefris Merid, Ethiopian Electric Utility. Meeting 1/10/18.

8 “Access to Electricity.” World Bank, https://data.worldbank.org/indicator/EG.ELC.ACCS.ZS. Accessed 1/26/18.

9 Ibid.

10 Freddy Mac (2014). “The four C’s of qualifying for a Mortgage.” http://www.freddiemac.com/blog/homeownership/20140507_4Cs_qualifying_mortgage.html

11 http://www.thinkgeoenergy.com/wp-content/uploads/2017/12/PressRelease_Corbetti_Ethiopia_Dec2017.pdf

12 “The Federal Democratic Republic Of Ethiopia Staff Report For The 2017 Article IV Consultation—Press Release; Staff Report; And Statement By The Executive Director For The Federal Democratic Republic Of Ethiopia.” International Monetary Fund (2018), http://www.imf.org/en/Publications/CR/Issues/2018/01/24/The-Federal-Democratic-Republic-of-Ethiopia-2017-Article-IV-Consultation-Press-Release-Staff-45576. p. 29-32.

13 “Government Support in Financing PPPs.” World Bank, http://ppp.worldbank.org/public-private-partnership/financing/government-support-subsidies. Accessed 2/3/18.